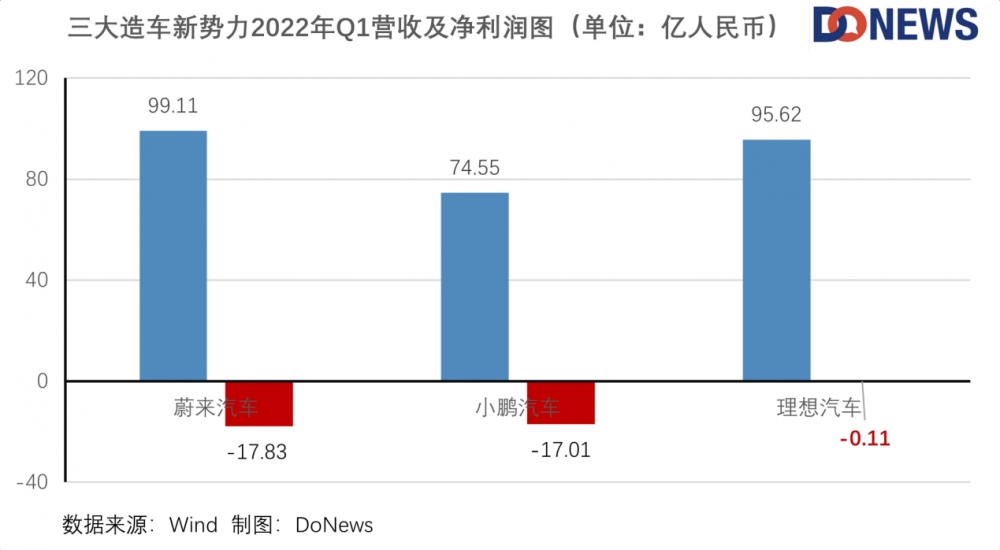

On the evening of June 9, NIO (hereinafter referred to as “NIO”) released its first-quarter financial report. According to the financial report, Weilai achieved revenue of 9.911 billion yuan in the first quarter of 2022, a year-on-year increase of 24.39%, but the profit was lower than expected, with a net loss of 1.783 billion yuan, and a loss of 450 million yuan in the same period in 2021, a year-on-year increase of 295.56%.

NIO’s revenue is composed of car sales and other sales. In the first quarter, car sales were RMB 9.2 billion, an increase of 24.8% year-on-year, and other sales (automotive services and energy packages) were RMB 700 million, an increase of 15.6% year-on-year. . Vehicle delivery reached 26,000 units, a year-on-year increase of 37.6%.

Li Bin, founder of NIO, said on the first-quarter earnings conference call: “Despite the challenges of the epidemic, demand for NIO’s products is still strong, and new orders in May hit a record high, especially for ET7, which continued to perform strongly.”

Among the new car-making forces, Weilai’s financial report was released at the latest. On May 10, Ideal Auto (hereinafter referred to as “Ideal”) released its financial report. The revenue in the first quarter was 9.562 billion yuan, a year-on-year increase of 167.49%, and the net loss reached 10.9 million yuan. The loss in the same period last year was 360 million yuan, a year-on-year decrease of 96.97%. . Xiaopeng Motors (hereinafter referred to as “Xpeng”) released its financial report on May 23. Its revenue in the first quarter was 7.455 billion yuan, a year-on-year increase of 152.59%, and its net loss was 1.701 billion yuan. The loss in the same period last year was 787 million, a year-on-year increase. Expanded by 116.20%.

Weilai: Losses expand, but also research and development

Growing costs, fragile supply chains

The general loss of new car-making forces is inseparable from the rising production costs of new energy vehicles.

NIO’s operating costs have increased for nine consecutive quarters, and the costs of Xpeng Motors and Li Auto are also on the rise throughout 2021. Chips and power batteries are the main drivers of the cost growth of new energy vehicles. Auto manufacturers have experienced the supply difficulty of “one core is difficult to find” as early as last year, and the current situation has not improved.

In the first-quarter 2022 conference call, when asked about NIO’s production capacity being constrained by chips in the second quarter, what is the outlook for chip supply in June and the second half of the year, Li Bin replied: “In terms of chips, it is There are often uncertain shortages. We probably have more than 1,000 chips per car, and this shortage may be a little different from time to time. Basically, in our risk list, generally speaking There are one or twenty chips, and ten or twenty kinds of chips, which may be different this month and next month, so we have to keep solving them.”

It can be understood as “still working on it”.

In terms of batteries, the mainstream power batteries in China are ternary lithium and lithium iron phosphate batteries. The main raw material is “lithium carbonate”. Since 2022, the price of lithium materials has risen rapidly. According to Wind data, the price of lithium carbonate on January 4, 2022 was 278,000/ton, and as of May 30, the price reached 462,500/ton, an increase of 66.36%.

When asked about NIO’s outlook on product pricing if battery costs continue to increase in the second half of the year, Li Bin said: “The high point in April has already begun to go down, and the most relevant factor is of course lithium. For related prices, some lithium mines are accelerating their mining, and some output has already begun. I think the overall material cost of batteries will go down, but there are indeed some uncertain factors in the market. This is a big direction, but there are different projections for how far.”

It can be understood as “hope to reduce the price, but I’m not sure”.

When the price of raw materials rises, the company’s supply chain management capabilities are extremely important.

According to CCTV Finance and Economics, domestic automakers such as Weilai, Xiaopeng, and Ideal rely on imported German companies such as Bosch for core components such as radar, ultrasonic sensors, chips, steering systems, and braking systems. . Even in a horizontal comparison, Weilai is less prepared than Xiaopeng and Ideal in terms of supply chain management.

In the prospectus for listing in Hong Kong, Weilai disclosed that most of the parts of the car are provided by a single supplier, and the company has not looked for qualified alternative suppliers. When emergencies occur in the upstream and downstream of the industrial chain, it may be difficult for Weilai to adapt to the situation. Xpeng also operates a single-supplier strategy, but in order to reduce risks, it uses a secure supply agreement to ensure reserves. In addition to signing contracts, Ideal has further planned a list of alternate suppliers for parts supply, and established a professional team to connect with chip suppliers as early as October 2020.

In the first quarter of 2022, NIO’s operating costs were as high as 8.464 billion yuan, an increase of 3.19% month-on-month, while Xiaopeng and Ideal decreased by 13.12% and 10.22% month-on-month, respectively. Affected by rising operating costs, Weilai’s gross profit margin in the first quarter was 14.60%, down 25.05% year-on-year, while Xiaopeng and Ideal’s gross profit margins were 12.22% and 22.63%, up 9.30% and 31.18% year-on-year, respectively.

Price increase, difficult to increase sales

In the face of rising raw materials, car companies generally choose to raise prices.

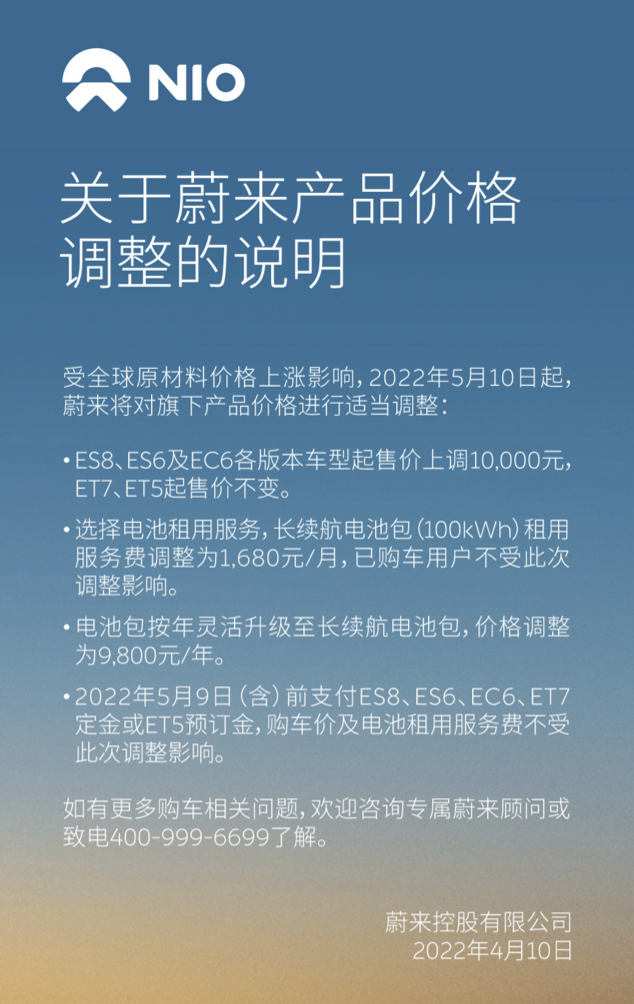

On April 10, 2022, NIO announced that starting from May 20, the starting price of each version of NIO ES8, ES6 and EC6 models will be increased by 10,000 yuan, which is affected by battery costs, battery rental services, and long-lasting batteries. The rental service fee is also adjusted to 1,680 yuan/month, an increase of 13.51%. The battery pack is flexibly upgraded to a long-life battery pack every year, and the price is also adjusted to 9,800 yuan/year.

Weilai: Losses expand, but also research and development

NIO Price Adjustment Instructions Image Source: Official Weibo

Ideal and Xiaopeng have already raised prices before. On March 21, the new prices of the three models of Xpeng Motors on sale, the P7, P5 and G3i, were released, with an increase of RMB 10,100 to RMB 32,600. On March 23, Ideal Auto officially announced that starting from April 1, 2022, the national unified retail price of Ideal ONE will be increased from 338,000 yuan to 349,800 yuan.

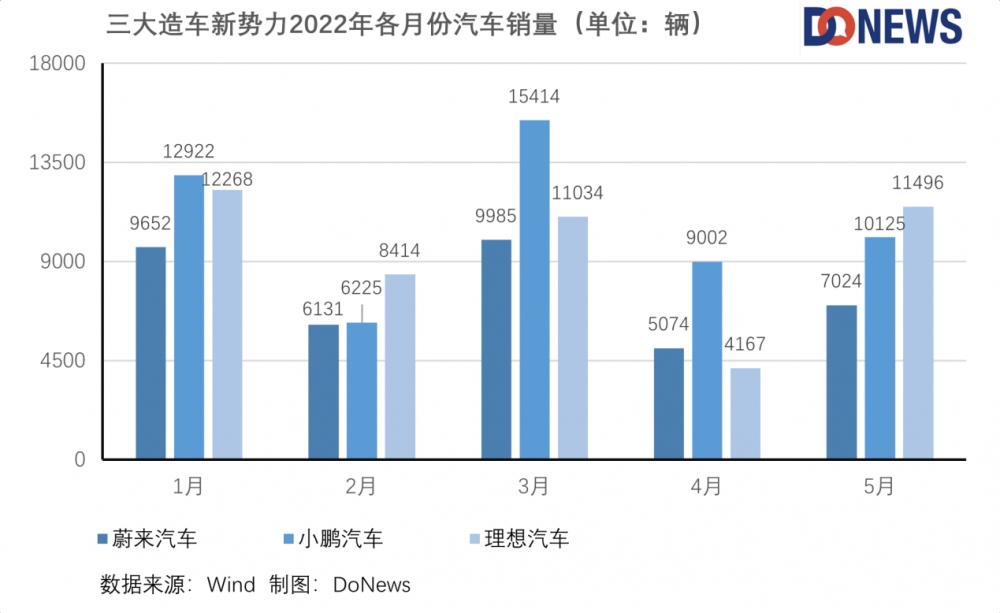

After NIO announced the price increase in April, the sales volume has been decreasing. The deliveries of NIO in April and May were only 5,074 and 7,024 (its deliveries in January, February and March were 9,652 and 6,131 respectively). and 9985). However, regarding the reasons for the decline in sales, Li Bin said in the first quarter results meeting: “Since the second half of March, a new wave of epidemics broke out in some parts of China, affecting the production and delivery of cars.”

NIO’s relevant suppliers are mainly concentrated in the Yangtze River Delta region, and the core automobile production plant is also in Hefei, Anhui. Affected by the Shanghai epidemic, some suppliers were forced to suspend production, which affected the production of automobiles. Also affected are Ideal and Xiaopeng. However, in May, the sales of Xiaopeng and Li Auto both exceeded 10,000, of which Xiaopeng delivered 10,125 vehicles and Li Auto delivered 11,496 vehicles, a month-on-month increase of 175.88%.

Weilai: Losses expand, but also research and development

At the same time, the sales of other new energy vehicle companies are also growing rapidly. According to data from the Passenger Federation, the retail sales of new energy passenger vehicles reached 360,000 in May this year, a year-on-year increase of 91.2% and a month-on-month increase of 26.9%. BYD’s new energy vehicle deliveries reached 114,943 units in the month, which has exceeded 100,000 units for three consecutive months; Nezha’s sales in May also reached 11,009 units, a month-on-month increase of 24.9%; Leap Motor’s May sales reached 10,069 units, A month-on-month increase of 10.8%.

Due to its positioning in the high-end market, Weilai missed many favorable policies introduced by the government, and the new energy vehicle companies enjoying the corresponding policies have further enhanced their market competitiveness.

On May 31, the Ministry of Finance and the State Administration of Taxation issued the “Announcement on Reduction and Collection of Vehicle Purchase Tax for Some Passenger Vehicles”. Tax) of 2.0-liter and below passenger cars with a displacement of not more than 300,000 yuan, the vehicle purchase tax will be halved.

Weilai: Losses expand, but also research and development

“Announcement on Reduction and Collection of Vehicle Purchase Tax for Some Passenger Vehicles”

Image source: State Administration of Taxation official website

In addition, 21 car companies (excluding Weilai) have given additional discounts, further discounting the “other half of the purchase tax” in the purchase tax reduction policy, and at the same time offering benefits such as insurance and quality assurance.

On the same day, the Ministry of Industry and Information Technology and other four departments also issued the “Notice on Carrying out 2022 New Energy Vehicles Going to the Countryside Activities” to organize a new round of new energy vehicles going to the countryside. 26 auto companies including FAW, SAIC, Great Wall, BYD, and a total of 70 new energy models under their umbrellas participated in this trip to the countryside.

Wei Lai, who once served as the “C position” in the new car-making forces, is “destroying everyone.”

Invest in R&D under performance pressure

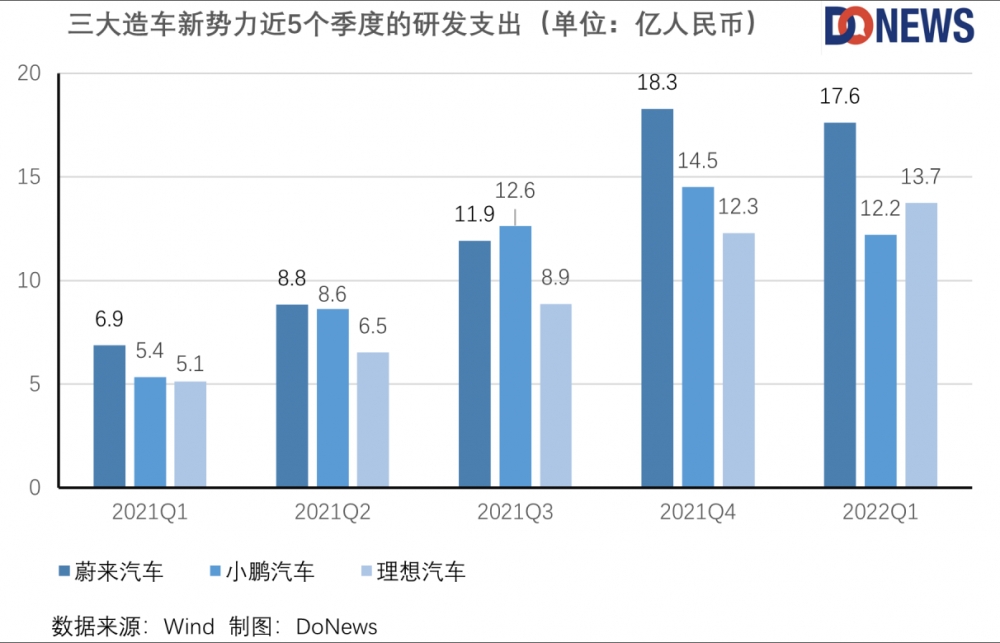

Weilai’s R&D expenses in the first quarter of 2022 were RMB 1.76 billion, an increase of 156% year-on-year. Feng Wei, chief financial officer of Weilai, said in the first quarter conference call: “The main reason for the larger year-on-year increase in R&D expenses is It is the increase in the cost of R&D function personnel, as well as the increase in the design and development cost of new products and new technologies.” In the first quarter conference call, Li Bin said that the research and development of new products and core technologies has always been one of NIO’s long-term strategic priorities.

Research and development expenses have always been the bulk of the expenditure of new car manufacturers. In the first quarter of 2022, Xiaopeng Motors’ research and development expenses were 1.221 billion yuan, a year-on-year increase of 128.22%; ideal car research and development expenses were 1.374 billion yuan, a year-on-year increase of 166.80%. In 2021, the research and development expenses of Weilai, Xiaopeng and Ideal will be 4.591 billion, 4.114 and 3.296 billion yuan respectively, accounting for 12.7%, 19.60% and 12.20% of the total revenue.

Weilai: Losses expand, but also research and development

For enterprises, investing in R&D is to prepare for longer-term development, but the automobile industry is an industry with high investment, long cycle, and continuous demand for funds. I have experienced the embarrassment of nearly breaking the capital chain many times. In the slump in the industry, both Xiaopeng and Ideal were reported to be laying off staff and involving the R&D department, and some of them even broke the contract of fresh graduates, but Weilai has no corresponding news for the time being, and has plans to increase R&D. , In terms of technology investment, Weilai looks like the more “ideal” one.

On March 25, Weilai revealed at the performance meeting that it will increase R&D investment in 2022, and the annual R&D investment will more than double. R&D. When listed in Singapore on May 20, Li Bin emphasized: “With the help of the Singapore International Economic and Technology Center, we will carry out in-depth cooperation with local scientific research institutions in Singapore, and further improve NIO’s global R&D and business in the Singapore Artificial Intelligence and Autonomous Driving R&D Center. layout.”

Weilai’s research and development mainly focuses on new products, intelligent technology and autonomous driving. For example, Li Bin introduced in the first quarter conference call: “Weilai has introduced more than 200 new functions on the NT2.0 platform, and adopted the next-generation voice interaction and emotion engine technology, and the interactive experience of NOMI has also been fully upgraded. , NIO’s full-stack self-developed algorithm-driven assisted driving system also performed well.”

In terms of assisted driving, NIO said that it will release NOP plus based on the high-precision map jointly developed with partners in the third quarter, which will be enhanced through software and hardware platforms, full-stack internal algorithms, and end-to-end tracking data collection and operation capabilities. Pilot auxiliary functions and serve NAD in more scenarios.

NIO’s most eye-catching move in research and development recently is to increase its investment in batteries. Li Bin said: “As of now, NIO has more than 400 employees engaged in battery-related technologies, including battery materials, battery and battery pack design, battery management systems, and manufacturing processes. The goal is to build and enhance our comprehensive battery R&D and industrialization capabilities. , to improve the long-term competitiveness and profitability of our products.”

Affected by the rising price of batteries, there are more and more players in the battery field. Recently, BYD invested 13 billion yuan, and the first production line of the production base project in Shengzhou, Shaoxing was officially opened. “BYD will provide batteries for Tesla,” Lian Yubo, executive vice president of BYD Group, said in an interview on June 8.

The road to scientific and technological research and development is long and difficult, but it is also the only way for the development of domestic new energy vehicles. Although NIO’s performance in the first quarter was average, it is hoped that NIO can bring new surprises to the industry in terms of products.

Original link:https://www.energy-storage.com.cn/58.html